Which of the Following Best Describes Free Cash Flow

After-tax cash flows from operations minus the increase in operating working capital minus the increase in fixed and other assets. Which of the following statements is CORRECT.

Solved Aa Aa E 6 Free Cash Flow Accounting Statements Chegg Com

Residual cash flow after taking into account operating cash flows including fixed assets aquisitions asset sales and working capital expenditures.

. Which of the following best describes free cash flow. 1 Free cash flow is the. Free cash flow can be used for various reasons including distributing it to stockholders and debtholders.

The formula to compute the free cash flow is shown below. Residual cash flow after taking into account operating cash flows including fixed-asset acquisitions asset sales and working-capital expenditures Cash flows generated by operating the business Suppose you are the only owner of a chain of coffee shops near universities. Residual cash flow after taking into account operating cash flows including fixed-asset acquisitions asset sales and working-capital expenditures Cash flows generated by operating the business Retiring debtthat is to.

Nonprofit free cash flow Operating cash flow - Working. Thus corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company s real cash position. Free cash flow is the amount of cash flow available for distribution to all investors after all necessary investements in operating capital have been made.

We review their content and use your feedback to keep the quality high. Which of the following statements best describes free cash flow. PART 1 1.

Free cash flow FCF represents the cash a company can generate after accounting for capital expenditures needed to maintain or. As an example let Company A have 22 million dollars of cash from its business operations Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. Underwriter is only responsible for half 50 of the issue.

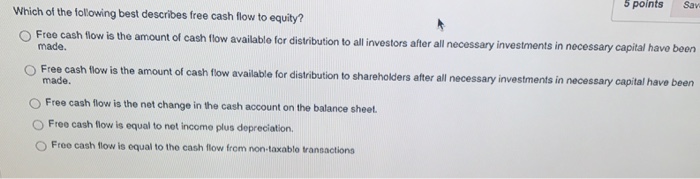

B Free cash flow is the amount of cash flow available for distribution to shareholders after all necessary investments in necessary capital have been made. C Free cash flow is the net change in the cash account on the. The free cash flow is the cash that is left after paying off the capital expenditure and other operation expenses.

EBIT minus intrest expense minus income taxes. Call options generally sell at a price greater than their exercise value and the greater the exercise value the. Free cash flow to equity is cash flow from operations less capital expenditures.

The amount of a firms available cash used to write off capital expenditures and depreciation The amount of a firms available cash that can be used without harming operations or the ability to produce future cash flows Suppose you are the only owner of a chain of coffee shops near. C Free cash flow is the net change in the cash account on the balance sheet D Free cash flow is equal to net income plus depreciation. The excess cash generated by revenues less all operating expenses The cash flwo available for distribution to all investors after the company has mode all investment in fixed asssets and working capital necessary to sustain a firm s ongoing operations Suppose tou are the only.

Which of the following statements best describes free cash flow. It is used in financial modeling and valuation. Free cash flow is the amount of cash flow available for distribution to all investors after all necessary investments in operating capital have been made.

Which of the following statements best describes free cash flow. The excess cash generated by revenues less all operating expenses. Underwriter commits to selling as much of the issue as possible at the agreed-on offering price but can return any unsold shares to the issuer without financial responsibility.

Free Cash Flow to the Firm FCFF This is a measure that assumes a company has no leverage debt. Answer If the underlying stock does not pay a dividend it does not make good economic sense to exercise a call option prior to its expiration date even if this would yield an immediate profit. Introduction to Corporate Finance 1 Which of the following best describes a best efforts underwriting commitment.

B Free cash flow is the amount of cash flow available for distribution to shareholders after all necessary investments in necessary capital have been made. B Free cash flow is the amount of cash flow available for distribution to shareholders after all necessary investments in necessary capital have been made. Free cash flow Operating cash flow - Working capital changes - Capital expenditures - Dividends.

EBIT 1 -Tax Rate Depreciation Amortization - Change in Net Working Capital - net capital Expenditure. Which of the following best describes free cash flow. A Free cash flow is the amount of cash flow available for distribution to all investors after all necessary investments in necessary capital have been made.

Which of the following best describes free cash flow. Which of the following statements best describes free cash flow. The free cash flow formula is as follows.

Free cash flow is the net change in the. Which of the following is not a use of free cash flow. E Free cash flow Is equal to the cash flow from non-taxable.

Gross profit minus EBIT. Hence correct option is a Cash flows ge. In this situation the revised formula is.

It is used in financial modeling and valuation. FCFE represents the maximum amount that can be paid as dividends to shareholders. Free Cash Flow Operating Cash Flow CFO Capital Expenditures Most information needed to compute a companys FCF is on the cash flow statement.

View the full answer. Where EBIT Earning before interest and tax. Free cash flow is the amount of cash flow available for distribution to shareholders after all necessary investements in operating capital have been made.

Free cash flow is the amount of cash flow available for distribution to shareholders after all necessary investments in operating. Free cash flow is arguably the most important financial indicator of a companys stock valueThe valueprice of a stock is considered to be the summation of the companys expected future cash flows. The calculation of free cash flow for a nonprofit entity is somewhat different since a nonprofit does not issue dividends.

Read more about FCFF Unlevered Free Cash Flow Unlevered Free Cash Flow is a theoretical cash flow figure for a business assuming the company is completely debt free with no interest.

Free Cash Flow To Firm Fcff Formulas Definition Example

Solved Aa Aa E 6 Free Cash Flow Accounting Statements Chegg Com

Solved Which Of The Following Best Describes Free Cash Flow Chegg Com

Comments

Post a Comment